There are so many aspects that go into running your eCommerce store - finding the right assortments of products, creating eye-catching product pages with beautiful images, reaching relevant customers with your marketing efforts, managing inventory and shipping - you probably think that deciding which payment methods to offer is of secondary importance.

A payment is a payment, right? Wrong! Selecting a payment method is one of the most critical elements of the customer journey and offering the right assortment of payment options is one of the most direct ways to impact your conversion rate.

Think of it this way: by the time a prospective customer has reached the payment phase of the checkout they have already made the purchase decision. They’ve found your site, chosen a product, selected the right size and color… they’ve already done all the hard work. Any friction with the payment process results in a lost sale. A customer is not a customer until they click that pay button. As an eCommerce site, you want to make clicking that button as easy as possible.

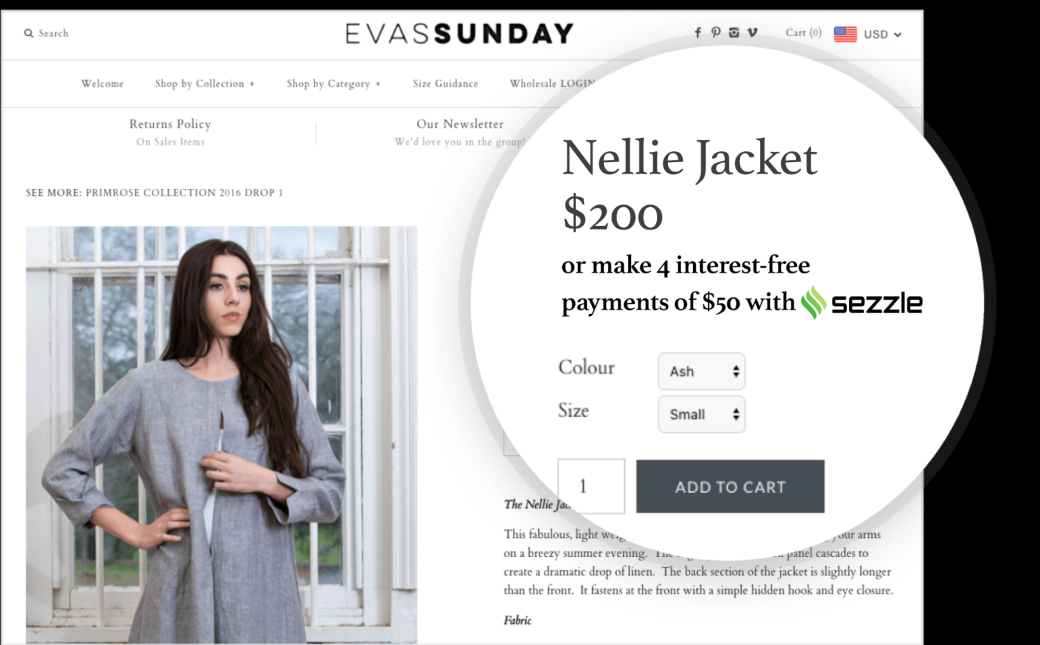

One payment method that is rapidly growing in popularity makes optimizing conversions at this critical juncture especially easy. New “shop now, pay later” solutions like Sezzle allow shoppers to pay for purchases over time.

What is a “Shop Now, Pay Later” Solution?

“Shop Now, Pay Later” solutions offer a new twist on point of sale financing for retailers with simple installment plans. Retailers have long provided shoppers the ability to pay over time with installments.

Layaway options became popular in the United States after the Great Depression when retailers began offering them as a way to generate sales with cash-strapped consumers. In the old layaway model, shoppers would physically go to the store and put down installment payments for merchants to hold an item they wanted. Once a shopper had made enough payments to cover the purchase, the sale was complete.

Then in the 1950’s a new innovation was introduced that allowed shoppers to pay over time: the credit card. Credit cards allowed shoppers to swipe, receive their item immediately, and then pay the credit card company back at a later date. Credit cards quickly expanded to the nearly ubiquitous presence they are in retail today. The downside of paying with credit cards is that they are only available to those who are approved for credit and they have the potential to quickly rack up exorbitant interest and fees.

New fintech solutions offer a modern alternative to credit cards designed for the modern consumer. For example, Sezzle enables shoppers to pay for purchases in four equal, interest-free installments.

Shoppers pay a percentage at the time of purchase and the merchant ships the item right away. The payment processor pays the merchant upfront for the full amount, less a small processing fee. The remaining installments are automatically collected from the shopper on a pre-established interval. There is no interest or additional cost to the consumer. The use of underwriting algorithm leverage alternative data that allows consumers who would not qualify for a credit card based on traditional credit scores to be approved. In short, These financing solutions provide a new way for shoppers to buy now, get their item now, and pay over time, at no additional cost.

The Benefits of Offering a “Shop Now, Pay Later” Option

Shop Now, Pay Later solutions are a proven way to increase sales for merchants. There are many benefits to adding an installment payment solution to merchants, including:

1. Reaching New Customers

If you want to maximize your reach, it is no longer sufficient to offer only credit card options. Credit cards are a great purchasing tool... for customers who have them. However, the number of credit card holders in your target audience might be far fewer than you think. Only one in three millennials owns a credit, according to a 2016 bankrate study.

There are many underlying factors driving this statistic - from the credit crisis of 2008, to mounting student loan debts for young people, to regulatory changes that made it more difficult for credit card companies to extend offers to those under the age of 21. The key point for merchants is that payment behaviors are changing dramatically for young consumers. Young shoppers have increasingly come to expect to be able to pay with a digital wallet, alternative payment platform, or an installment plan. By not providing these options, you are leaving potential sales in the cart.

2. Increasing Conversions

More than two-thirds of all online shopping carts are abandoned, according to the Baymard Institute. The second most commonly cited reason was the cart becoming too expensive. When customers see the total tallied up, they get sticker shock. Offering an installment payment solution that lets shoppers check out now and pay over time dramatically reduces cart abandonment rates. For stores that have added Sezzle, checkout conversions have increased by 38.7% for first time visitors. Reducing sticker shock of a one time purchase reduces cart abandonment, which means more sales!

3. Tapping Into a Millennial Trend

“Shop now, pay later” solutions have exploded in popularity in recent months. In other parts of the world, similar payment methods have become the predominant form of payment. Young people are driving this trend. Young shoppers like the freedom of paying over time, without the financial pitfalls that credit cards pose. For them, they see these solutions as a kind of layaway on-demand or layaway for the digital age. As more and more major brands accept these payment methods, the trend will only accelerate.

Comparing “Shop Now, Pay Later” Providers

Due to the rise in consumer demand for these services, several alternative payment methods have emerged to allow shoppers to pay over time. Here is a comparison of some the key players:

Affirm

Affirm is one of the more established and well known point of sale financing solutions. Affirms offers consumers installment loans of 3-36 month durations. Affirm offers varying terms depending on the merchant site and consumer credit history. A third of Affirm's loans have a 0% APR, and they offer interest bearing loans at 10-30% APR with simple interest. Affirm's platform is customizable to serve any customer, in any channel, at any price point.

Klarna

Klarna is a financial services company best known in the European market that offers several payment products. Klarna’s services include traditional one-time payment, the ability to delay payment for up to 14 days, the option to finance a purchase and pay monthly installments, or an option to pay in four equal installments every 2 weeks. Klarna’s various options provide versatility, however the differences can be confusing to shoppers. Klarna is not as widely used in the U.S. as some of the other alternative payment options on this list.

PayPal Pay in 4

PayPal Pay in 4 is a relatively new offering from one of the most established online payment providers in existence. It lets customers choose to divide their purchase into 4 payments, each scheduled 2 weeks apart (convenient for splitting a purchase so it's timed with paychecks). It does not charge interest to the customer, and there's no extra fee for implementation, as it's included within your normal PayPal rates. Your business is paid up front at the time of purchase, with PayPal assuming the risk and responsibility of getting payments from the customer.

Sezzle

Sezzle’s mission is to financially empower young consumers. Sezzle’s payment platform helps consumers gain access to additional purchasing power via simple, interest-free installment plans. Sezzle offers shoppers a consistent experience of 4 installments, over 6 weeks, with no interest or additional fees. As a result of the simplicity, ease of use, and customer service, Sezzle scores high marks for customer satisfaction. Sezzle is most successful with stores that see average order values between $50 - $1,000.

The Best Pay Later Solution for Small Businesses

Shop Now, Pay Later payment solutions are a proven way to reach new consumers, increase conversions, and tap into a rapidly growing retail trend. The right payment solution can have a dramatic impact on merchants’ sales and customer lifetime value.

As merchants consider which payment methods to use, they should think of the customer first. In the customer’s mind, the payment process is an extension of the store. A bad payment experience - whether it involves high interest rates or getting hit with hidden fees - equates to a negative shopping experience. Therefore, it’s important that merchants align themselves with payment options that fit with their values and customer experience standards.

Leave a reply or comment below